Why You’ll Lose Millions Without the Right Exit Team

Why having the right team of professionals could make or break your exit.

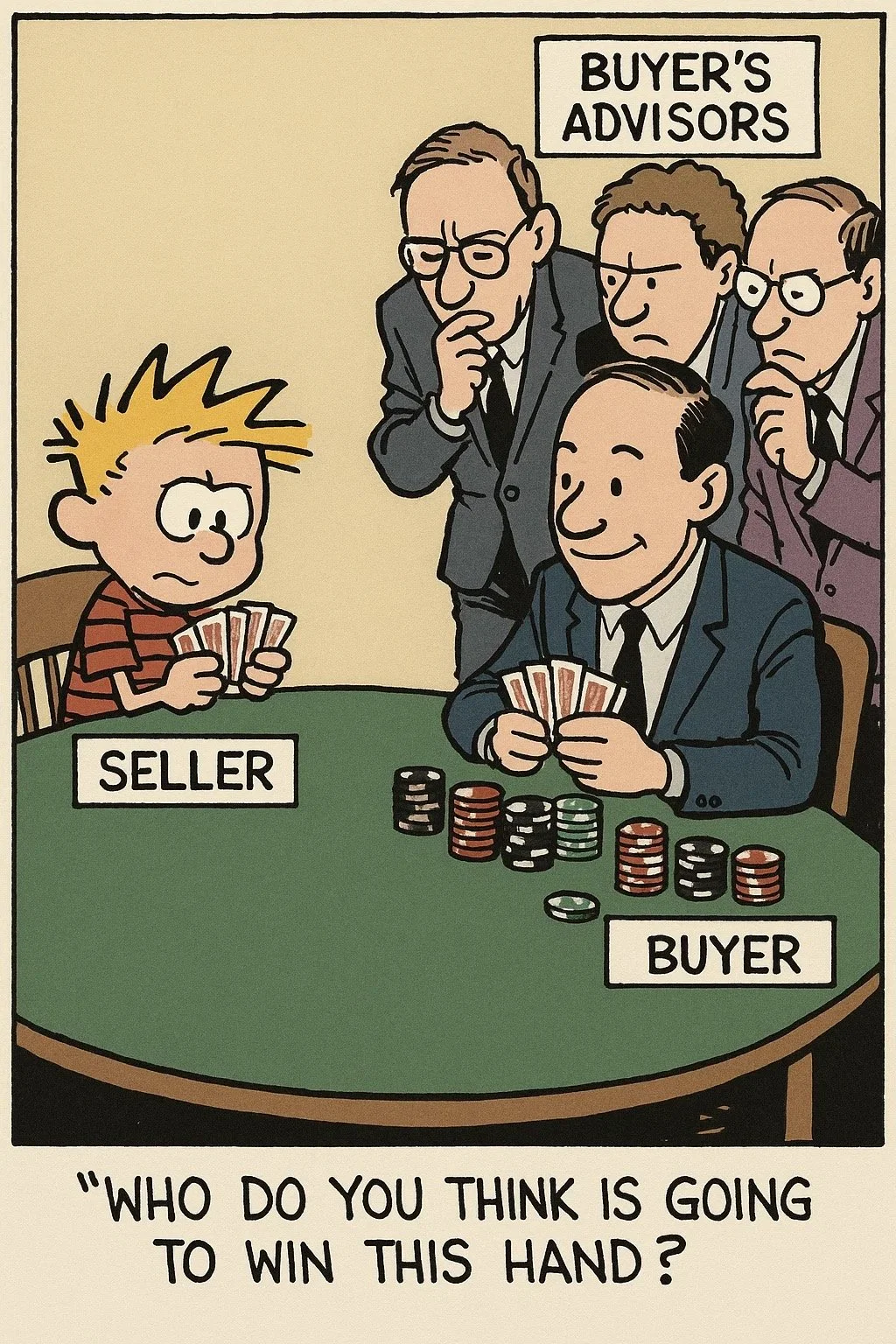

The Poker Game You Can’t Afford to Lose

Picture this.

You’re sitting at a high-stakes poker table. The air feels heavy. Every move matters.

Across from you sits the buyer—calm, confident, surrounded by a small army of advisors. Lawyers, analysts, accountants—all whispering strategy in his ear. Every chip he slides forward has been calculated, modeled, and reviewed ten different ways.

And then there’s you.

Alone.

Holding your cards, trying to read his face, hoping you’ve got a winning hand.

Now tell me—who do you think is going to win that game?

The Hidden Risk Most Owners Miss

Here’s the truth: selling your business isn’t just another deal.

It’s the deal—the single most important financial transaction of your life.

But most owners don’t realize they’re walking into that high-stakes game until the cards are already on the table. By the time a buyer shows up—with their team of specialists—the owner is already at a disadvantage.

Too many founders lean on their regular CPA or attorney to help them through the exit. They might be great in their roles, but selling a business is a completely different game. That’s like bringing a butter knife to a gunfight.

Buyers—especially private equity groups, strategic acquirers, and financial investors—do this every single day. They’ve seen every trick, every loophole, every negotiation tactic. They don’t just know the playbook; they wrote it.

If you walk in alone, you’re not just outnumbered—you’re outgunned.

Level the Playing Field: Build a World-Class Advisory Team

So how do you even the odds?

You build your own team—a World-Class Advisory Team that protects your blind spots, strengthens your position, and shifts power back in your favor.

Here’s who should be sitting at your table:

Exit/Value Advisor: Prepares your business for sale, increases enterprise value, and identifies hidden gaps.

M&A Advisor or Investment Banker: Structures the deal, manages negotiations, and finds the right buyer.

CPA with Exit Experience: Handles tax strategy, deal modeling, and financial due diligence.

Estate & Wealth Attorney: Safeguards your wealth and ensures your legacy is protected.

Personal Financial Planner: Makes sure the deal actually funds the next chapter of your life.

Each of these professionals adds leverage, foresight, and protection that most owners never even realize they’re missing—until it’s too late.

Why It Matters

Without the right team, even the smartest founder can get picked apart in due diligence.

Buyers exploit gaps, push for concessions, and structure deals that quietly cost you millions in taxes or valuation.

But with the right team behind you? Everything changes.

You gain leverage.

You reduce risk.

You walk into the negotiation with quiet confidence—because you know you’re not alone.

And that confidence itself adds value. Buyers can sense when they’re facing a prepared seller. It changes the tone of every conversation.

A Costly Lesson

I once worked with a founder who tried to go it alone.

He’d built an incredible company and was eager to cash out—but when the buyer’s due diligence team descended, he was overwhelmed. They buried him in requests, manipulated deal terms, and almost convinced him to accept a structure that would’ve cost him $4 million in unnecessary taxes.

Thankfully, he hit pause.

We brought in the right advisors—tax, legal, and M&A specialists—who restructured the deal.

When the dust settled, he walked away not just with the premium exit he deserved, but with peace of mind knowing he hadn’t left a fortune on the table.

The Takeaway

You wouldn’t go into battle without an army.

You wouldn’t sit at a poker table against professionals without knowing the game.

Exiting your business is no different.

The buyer will have a team—an army of experts working to get their best deal.

The only question is… will you have yours?

Ready to See How Exit-Ready Your Business Really Is?

Take the Exit Readiness Scorecard — it’s a 3-minute assessment that shows where you stand today and what to focus on next to build a business buyers fight over.