Why 90 Percent of Business Owners Leave Millions on the Table When They Exit

Most owners only exit once. And when you only do something once, it’s very hard to not make big mistakes.

You Need an Exit Advisor Long Before You Exit

Most business owners assume that if they’ve built a great company, they’ll automatically have a great exit. The logic feels sound — strong business in, strong exit out.

But here’s the truth few owners ever hear:

Owning a great business does not guarantee a great exit.

In fact, nearly ninety percent of owners leave money on the table when they sell. And it’s rarely because of poor performance or weak demand. More often, it’s because they started preparing far too late. They treated the exit as a single moment instead of what it truly is — a multi-year transformation of the business, the financials, and the owner.

The difference between those who walk away disappointed and those who walk away with life-changing outcomes is simple: the top ten percent bring in the right exit advisors early. They don’t wait for the buyer to appear. They prepare long before the market ever sees them.

When a serious buyer shows up, they come with a team: analysts, accountants, tax strategists, attorneys, negotiators, and due diligence specialists who live and breathe acquisitions. They evaluate dozens of companies a month. They know what to look for, and more importantly, what to discount.

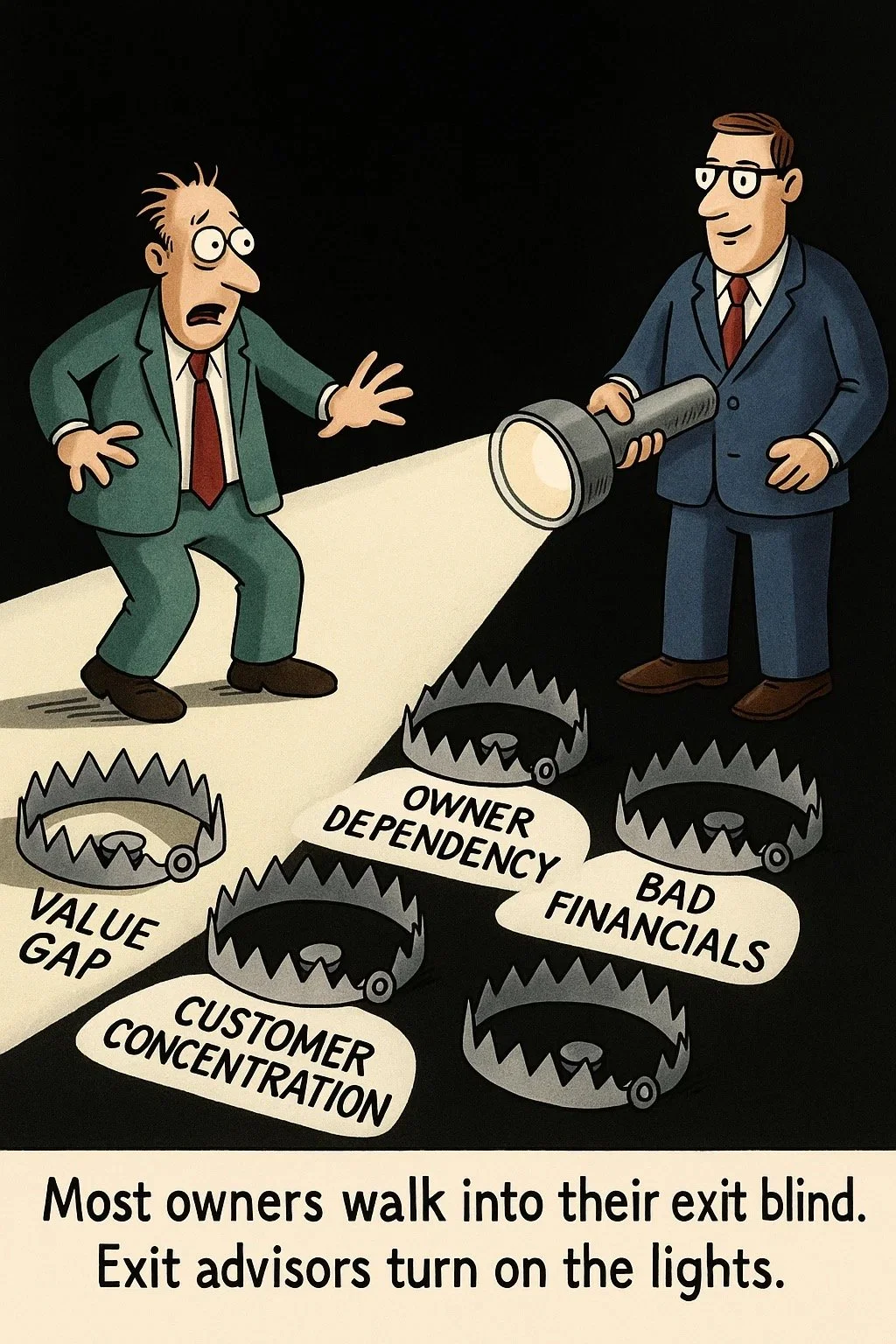

Most owners walk into that same process alone — or with a general CPA who has never guided a sale. And that’s where the leverage shifts. A strong exit advisor closes that gap and gives the owner back the advantage the buyer already assumes they’ll have.

One of the first and most important things an exit advisor does is help owners identify value gaps long before a buyer can exploit them. These gaps are often invisible to the founder: thin margins, customer concentration, heavy owner dependency, weak recurring revenue, lack of documented processes, or an undeveloped leadership bench. Any one of these can quietly drain millions off a valuation. Combined, they can cut it in half. Buyers notice these weaknesses immediately. A good advisor helps the owner find them, fix them, and fortify the business so those gaps don’t surface in negotiations.

Transferability is another element buyers care deeply about — and it’s the number one multiplier driver in most deals. If the business falls apart when the owner steps away, the exit number collapses with it. Exit advisors help owners engineer a company that runs on systems, not the founder’s willpower. When a buyer sees that the business will continue performing without the owner, the risk drops and the valuation climbs.

And then there’s the team — not the internal team, but the advisory team. A sale requires legal, tax, financial, operational, and wealth-planning expertise. Exit advisors don’t replace these experts; they orchestrate them. They coordinate, challenge, translate, and align everyone around the owner’s goals so nothing is missed and no value leaks through the cracks. Deals fall apart not because of what owners know, but because of what they don’t know to prepare for.

Perhaps the biggest advantage of bringing in an advisor early is this: they help increase valuation long before buyers ever see the business. Too many owners wait until someone is interested before they get serious about improving margins, diversifying revenue, tightening financials, or building leadership depth. But the buyer has already done their homework. They already know where the business is weak. When you start preparing after the buyer arrives, you are already negotiating from behind.

An exit advisor ensures the business is packaged, positioned, and strengthened years before an LOI appears — which not only improves the valuation but shifts power back to the seller.

Without this preparation, most owners walk into the biggest financial event of their lives unprepared. They never fixed customer concentration. Never strengthened their margins. Never documented their processes. Never built recurring revenue. Never developed a leadership bench. Never removed themselves from operations. Never cleaned up their financials. Never built a life-after-exit plan.

Then the buyer arrives, sees all the weaknesses at once, and does exactly what buyers are trained to do — adjust the offer to match the risk.

The difference between a $2 million exit and a $10 million exit is rarely the market, the timing, or the buyer.

It’s preparation.

It’s structure.

It’s positioning.

It’s the strategy applied long before the owner ever intends to sell.

That’s the work we do at Elevate & Exit. We help founders engineer a premium exit before the process even begins — because once you’re already exiting, it’s too late to build the value you hoped to receive.

If you want to understand where your business stands today and how much value might be at risk, start with the Exit Readiness Scorecard. It’s quick, eye-opening, and often the starting point for transforming a business from “sell someday” to “sell on your terms.”

Because the best time to prepare for your exit was five years ago.

The second-best time is right now.

Ready to See How Exit-Ready Your Business Really Is?

Take the Exit Readiness Scorecard — it’s a 3-minute assessment that shows where you stand today and what to focus on next to build a business buyers fight over.